Help elephants with a tax-smart donation from your IRA

Are you 70 1/2 or older and not using your Required Minimum Distribution (RMD) for your living expenses? You can reduce your taxable income by using your RMD to make an IRA Qualified Charitable Distribution to an eligible charity like Elephant Aid International (EAI).

The Basics

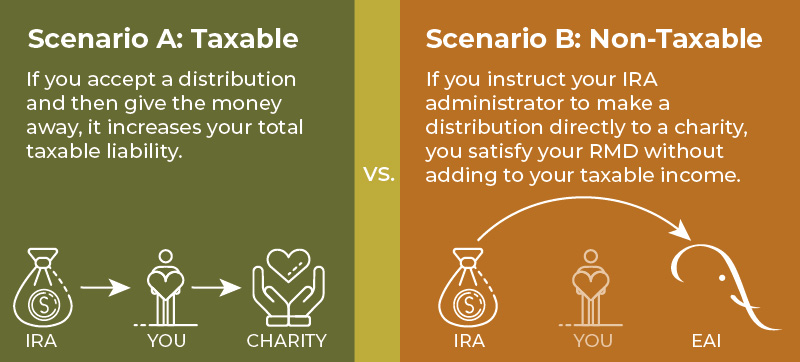

Since an IRA is a tax-deferred retirement account, contributions within stated limits are tax deductible, and appreciation and earnings are not taxed until they are withdrawn. When IRA owners reach age 70½, they are required to take yearly minimum distributions —even if they don’t want or need the income. IRA distributions are taxed as ordinary income, which could mean unfavorable tax implications depending on your financial circumstances. A one-step solution could be to request an IRA Qualified Charitable Distribution to a favorite charity, because IRA Qualified Charitable Distributions are not taxable as income. The important part to remember is that the distribution must pass directly to the recipient charitable organization.

How an IRA Qualified Charitable Distribution Works

- Direct a transfer from your IRA account to Elephant Aid International (or other eligible charity).

- Exclude the gift amount from your income for federal tax purposes.

- Count the gift toward your Required Minimum Distribution for the year.

- Make a positive impact for elephants in need.

(Note: maximum distribution allowance is $100,000 per year.)

Example:

If you have turned 70 ½ and will be taking $1,000 out of your IRA this year, you might pay an additional $350 in income taxes (if your income tax bracket is 35%), leaving you with about $650 in total.

Instead you can direct the entire distribution to Elephant Aid International, and the full $1,000 will go directly to help improve elephant welfare.

This distribution will not affect your taxes.

Timing

If you are considering making an IRA Qualified Charitable Distribution, please initiate the process by December 20th, so the charity receives and and is able to cash the distribution check before year’s end. In order for the distribution tax benefit to apply to the current year, your IRA administrator must have evidence of the check being cleared.

Ready to Notify your IRA Administrator?

It’s easy when you use this sample distribution request letter. Just copy the text below and fill in the blanks or download a fillable PDF of the sample distribution request letter.

[Your Name]

[Your Address][Date]

[Name of IRA administrator]

[IRA Administrator Address]RE: Request for a Qualified Charitable Distribution or Charitable Rollover from IRA

Dear IRA administrator:

Please accept this letter as my request to make a qualified charitable distribution, also known as a charitable rollover from my Individual Retirement Account #[ ______________________] as provided in The Protecting Americans from Tax Hikes Act of 2015 and Section 408(d)(8) of the Internal Revenue Code of 1986, as amended.

Please issue a check in the amount of $[___________] payable to Elephant Aid International and mail it to:

Elephant Aid International

404 Laslie Road

PO Box 283

Attapulgus, GA 39815In your transmittal, please include my name and address as the donor of record in connection with the distribution and copy me.

It is my intention that this distribution qualify for exclusion from my taxable income during the [insert tax year] tax year.

If you have any questions or need to contact me, I can be reached at [insert contact information].

Thank you.

[Your Name and Email]

Please alert us about your gift via a qualified charitable distribution, as checks may arrive without identifiable information. Please email [email protected] and include your mailing address so we may acknowledge your donation.